Big Movers 11/6/24

- Brett Hall

- Nov 6, 2024

- 4 min read

AMAZON:

News Today: Loop Capital increased its price target for Amazon from $225 to $275, keeping a buy rating. Analysts report an average buy rating for Amazon, with targets between $180 and $285.

Current Signal: Buy

Trend: Bull

Trend Movement: Overbought

Trend Volatility: 100%

Trend Mood: Optimistic

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 72.23 M

Average 30D Volume: 36.3 M

Market Cap: 2.18 T

SALESFORCE:

News Today: Harris Parker, Co-Founder and CTO of Slack and Director at Salesforce, sold 3,970 shares of Salesforce Common Stock on November 5, 2024, for a total sale amount of $1,178,044. The transactions were executed at weighted average prices ranging from $295.545 to $298.55. Following these transactions, Parker directly owns 119,402 shares and indirectly owns 1,808,478 shares of Salesforce Common Stock through various entities. The sales were conducted under a Rule 10b5-1 trading plan adopted on September 26, 2023.

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 5.87 M

Average 30D Volume: 4.25 M

Market Cap: 293.4 B

Alphabet:

News Today: Loop capital raised its price target for google from $170 to $185, keeping a ‘hold’ rating. Analysts note the average rating for google is ‘outperform’, with targets between $151 and $240.

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 98.2%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 27.04 M

Average 30D Volume: 16.84 M

Market Cap: 2.17 T

Guidewire Software:

News Today: Amphenol’s making waves in the Computer and Technology sector, which holds a solid Zacks Sector Rank of #4 out of 16. With a Zacks Rank of #2 (meaning "Buy"), it’s caught the attention of analysts expecting solid growth in the next few months. Analysts have upped their full-year earnings estimate for Amphenol by 5.4% this past quarter—indicating strong confidence in its outlook. This year alone, Amphenol’s stock is up a solid 40.8%, leaving the sector’s average gain of 26.4% in the dust. For investors, it’s been a strong contender in the tech arena.

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Optimistic

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 625.02 K

Average 30D Volume: 815.57 K

Market Cap: 16.03 B

Jones Lang LaSalle:

News Today: Earnings...

Total Revenue: $5,868.8 million, increased by 15% compared with the prior-year quarter.

Total Revenue: $16,622.0 million for the first nine months of 2024, up 12% compared with 2023.

Operating Income: $228.3 million, increased by 92% compared with the prior-year quarter.

Operating Income: $494.9 million for the first nine months of 2024, up 73% compared with 2023.

Net Income: $155.1 million, increased from $59.7 million in the prior-year quarter.

Net Income: $305.6 million for the first nine months of 2024, up from $53.0 million in 2023.

Basic EPS: $3.26, increased from $1.25 in the prior-year quarter.

Basic EPS: $6.43 for the first nine months of 2024, up from $1.11 in 2023.

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 95.8%

Trend Mood: Normal

Short Term: Down

Intermediate Term: Up

Long Term: Up

Today's Volume: 861.34 K

Average 30D Volume: 302.75 K

Market Cap: 12.44B

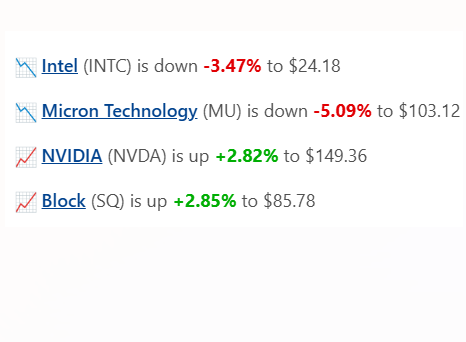

INTEL:

News Today: Intel shares rose by 3.8% in premarket trading, contributing to a broader increase in US chip stocks amid political developments.

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Down

Today's Volume: 116.67 M

Average 30D Volume: 65.2 M

Market Cap: 108.04 B

Micron Technology:

News Today: Micron Technology shares increased about 2.6% and 5.6% post election, despite Donald Trump’s criticism of the Chip Act aimed at boosting US semiconductor production.

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 91.7%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Down

Today's Volume: 20.29 M

Average 30D Volume: 23.2 M

Market Cap: 123.99 B

NVIDIA:

News Today: NVIDIA Corporation’s market cap hit $3.44 trillion following a hefty rise. Its leadership in AI chips fueled over 200% growth in the past year, leading analysts boost revenue projections for upcoming earnings.

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 241.64 M

Average 30D Volume: 240.88 M

Market Cap: 3.57 T

BLOCK:

News Today: Block is a technology company with a focus on financial services. Made up of Square, Cash App, TIDAL, and TBD, the company builds tools to help expand access to the economy. The company is actually on the reporting docket this week, with its results scheduled for Thursday after the market’s close.

Earnings and revenue expectations have remained stagnant for the quarter to be reported, with current consensus expectations alluding to a 60% pop in EPS on 10% higher sales. The company’s sales growth has been explosive over recent years.

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 10.37 M

Average 30D Volume: 5.28 M

Market Cap: 47.8 B

Comments