Big Movers 11/11/24

- Brett Hall

- Nov 11, 2024

- 3 min read

SALESFORCE: SCORE - 67 (BUY)

News Today: Jefferies raised its price target on Salesforce to $400 from $350, keeping a buy rating. Following this, Salesforce surged by 5.3% to 6.2%, becoming the top gainer on the Dow.

IMMEDIATE SIGNALS

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 13.59 M

Average 30D Volume: 4.67 M

Market Cap: 326.69 B

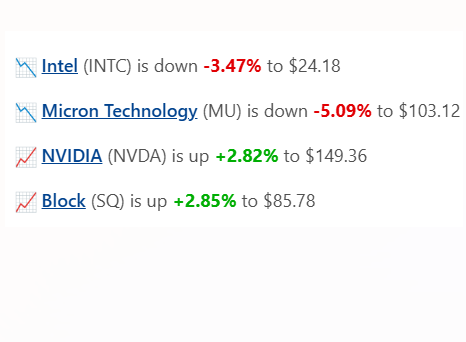

Intel: SCORE - 44 (SELL)

News Today: Intel EVP & GM Michelle Johnston Holthaus Sells 25,000 Shares.

IMMEDIATE SIGNALS

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Down

Intermediate Term: Up

Long Term: Down

Today's Volume: 80.05 M

Average 30D Volume: 65.55 M

Market Cap: 108.04 B

MercadoLibre: SCORE - 51 (BUY)

News Today: Latin American e-commerce and fintech giant MercadoLibre MELI has seen its stock decline 11.6% following its third-quarter 2024 earnings release, despite reporting robust growth across its business segments. In the third quarter, the company reported earnings of $7.83 per share, which missed the Consensus Estimate by 30.52% but increased 9.4% year over year. Revenues rose 35% on a year-over-year basis (103% on a FX-neutral basis) to $5.3 billion.

IMMEDIATE SIGNALS

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 94.8%

Trend Mood: Normal

Short Term: Down

Intermediate Term: Up

Long Term: Down

Today's Volume: 987.48 K

Average 30D Volume: 429.63 K

Market Cap: 99.43 B

Micron Technology: SCORE - 46 (SELL)

News Today: Taiwan Semiconductor stock took a hit after the U.S. Department of Commerce instructed the chipmaker to cease supplying China with sophisticated chips—of 7 nanometers or more advanced designs—that support AI and graphics processing capabilities. The U.S. move sent jitters across the sector, anticipating further actions from President-elect Donald Trump’s administration, which had previously attacked the US Chips Act and Taiwan the hometown of Taiwan Semiconductor.

IMMEDIATE SIGNALS

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 99.8%

Trend Mood: Normal

Short Term: Down

Intermediate Term: Up

Long Term: Down

Today's Volume: 14.47 M

Average 30D Volume: 18.82 M

Market Cap: 120.46 B

PayPal Holdings: SCORE - 52 (BUY)

News Today: With the increased adoption of digital payments and demand for cryptocurrency fintech companies' future appears bright. Amid a sea of rising fintech players, PayPal Holdings' PYPL recovery is spectacular.

PayPal has experienced both highs and lows in recent years, driven by shifting market dynamics, competitive pressures, and changing consumer behaviors. However, under the leadership of new CEO James Alexander Chriss, the company’s growth story has started to take a new turn. Its recent third-quarter results showed significant progress, reigniting growth. PayPal stock has surged 41% year to date outperforming the S&P 500 Index's SPX gain of 26.4% Nonetheless, Wall Street expects more than 45% upside next year.

IMMEDIATE SIGNALS

Current Signal: Buy

Trend: Bull

Trend Movement: Overbought

Trend Volatility: 100%

Trend Mood: Optimistic

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 15.54 M

Average 30D Volume: 10.36 M

Market Cap: 87.16 B

Block: SCORE - 56 (BUY)

News Today: Block Price Target Announced at $83.00/Share by Piper Sandler.

IMMEDIATE SIGNALS

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 82.8%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 20.90 M

Average 30D Volume: 6.83 M

Market Cap: 51.34 B

Comments