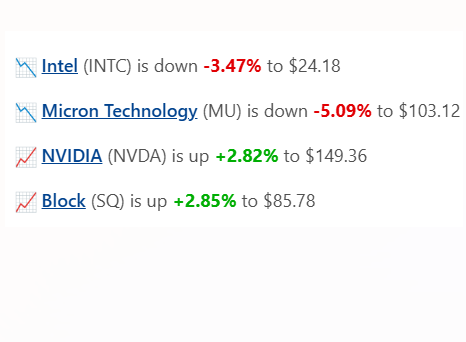

Big Movers 11/12/24

- Brett Hall

- Nov 12, 2024

- 3 min read

Intel: SCORE - 48 (SELL)

News Today: German chipmaker Infineon said on Tuesday that it expected "subdued" performance in 2025, citing weak demand in its end markets.

"With the exception of artificial intelligence, our end markets are currently offering hardly any growth impetus and the cyclical recovery is delayed," said CEO Jochen Hanebeck. "We are therefore preparing for a subdued business performance in 2025."

Infineon's results are broadly in line with rivals, with Intel posting a quarterly revenue drop last month as losses mounted at its contract manufacturing business.

IMMEDIATE SIGNALS

Current Signal: Buy

Trend: Average

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Down

Intermediate Term: Up

Long Term: Down

Today's Volume: 62.38 M

Average 30D Volume: 64.75 M

Market Cap: 104.20 B

Micron Technology: SCORE - 42 (SELL)

News Today: On Tuesday, Micron Technology, Inc. MU launched the qualification process for its 6550 ION NVMe SSD, the world’s fastest 60TB data center SSD and the first in the industry to offer E3.S and PCIe Gen5 60TB capabilities.

Building on the success of the award-winning 6500 ION, the 6550 ION is designed for optimal performance, energy efficiency, endurance, security, and rack density, catering to exascale data center needs.

It is ideal for high-capacity NVMe workloads, including networked AI data lakes, data ingestion, preparation, checkpointing, file and object storage, public cloud storage, analytic databases, and content delivery.

IMMEDIATE SIGNALS

Current Signal: Sell

Trend: Bear

Trend Movement: Average

Trend Volatility: 76.3%

Trend Mood: Normal

Short Term: Down

Intermediate Term: Up

Long Term: Down

Today's Volume: 21.82 M

Average 30D Volume: 17.80 M

Market Cap: 115.42 B

Nvidia: SCORE - 59 (BUY)

News Today: Nvidia stock gained Tuesday and snapped a two-day losing streak.

Nvidia shares were up 2.1% at $148.29 at the close. The stock fell 1.6% on Monday, extending a slide that began on Friday after the stock rallied to record highs on Thursday.

The next test for the stock is the company's quarterly earnings report on Nov. 20. Nvidia is expected to post adjusted earnings of 70 cents a share on revenue of $32.96 billion for the October quarter, according to FactSet.

Morgan Stanley analyst Joe Moore kept an Overweight rating and $160 price target on Nvidia stock heading into the earnings announcement. However, he noted that a limited supply of its chips could make it more difficult to deliver the kind of earnings and guidance the market has become used to.

IMMEDIATE SIGNALS

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 197.68 M

Average 30D Volume: 229.56 M

Market Cap: 3.64 T

Block: SCORE - 68 (BUY)

News Today: Block Price Target Raised to $120.00/Share From $95.00 by Canaccord Genuity.

For the current quarter, Block is expected to post earnings of $0.91 per share, indicating a change of +102.2% from the year-ago quarter. Rough estimate has changed -0.9% over the last 30 days.

The consensus earnings estimate of $3.55 for the current fiscal year indicates a year-over-year change of +97.2%. This estimate has changed -0.2% over the last 30 days.

IMMEDIATE SIGNALS

Current Signal: Buy

Trend: Bull

Trend Movement: Average

Trend Volatility: 100%

Trend Mood: Normal

Short Term: Up

Intermediate Term: Up

Long Term: Up

Today's Volume: 15.14 M

Average 30D Volume: 7.11 M

Market Cap: 53.69 B

Comments